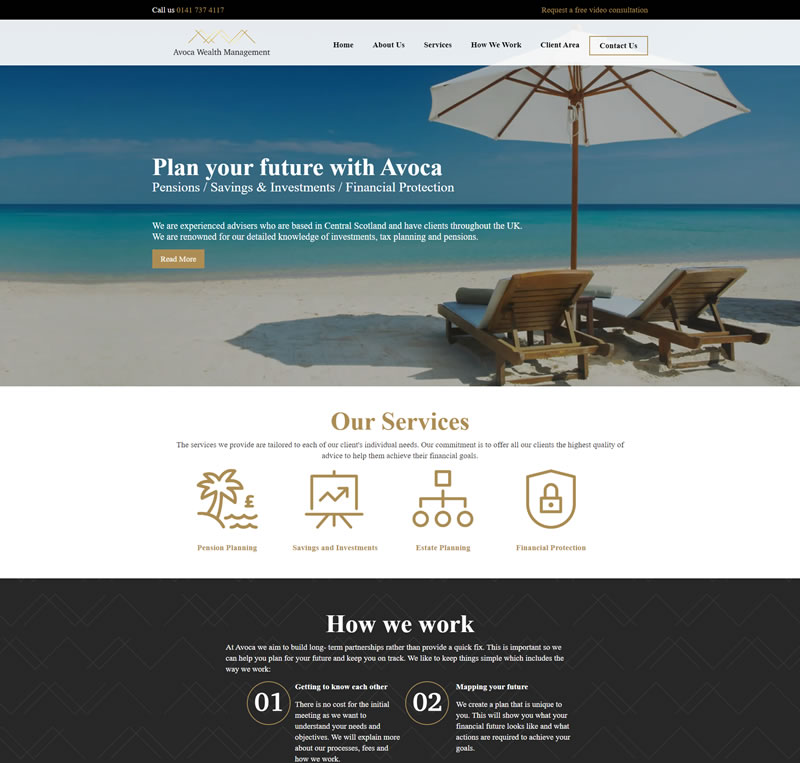

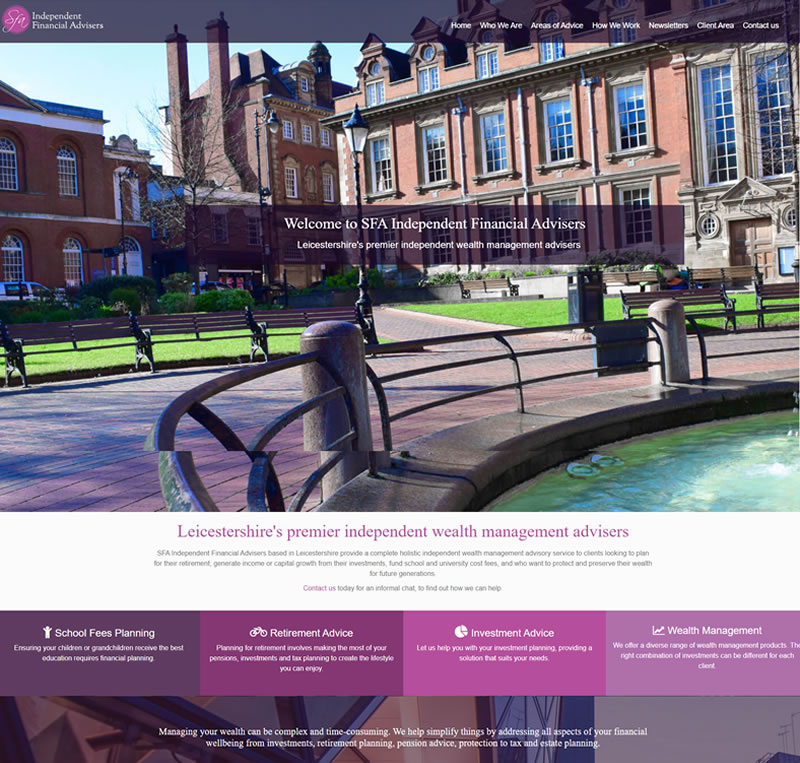

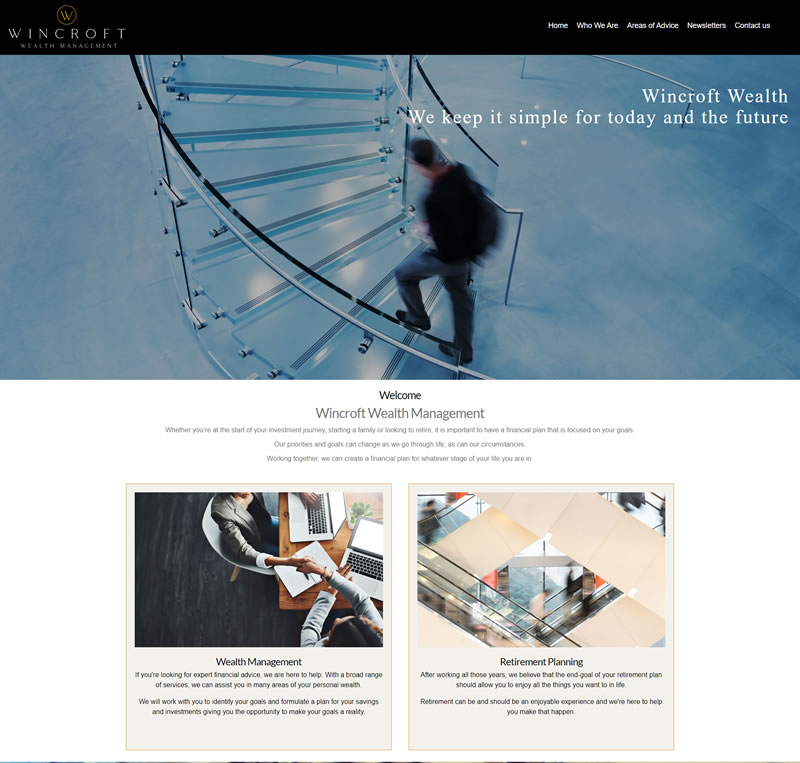

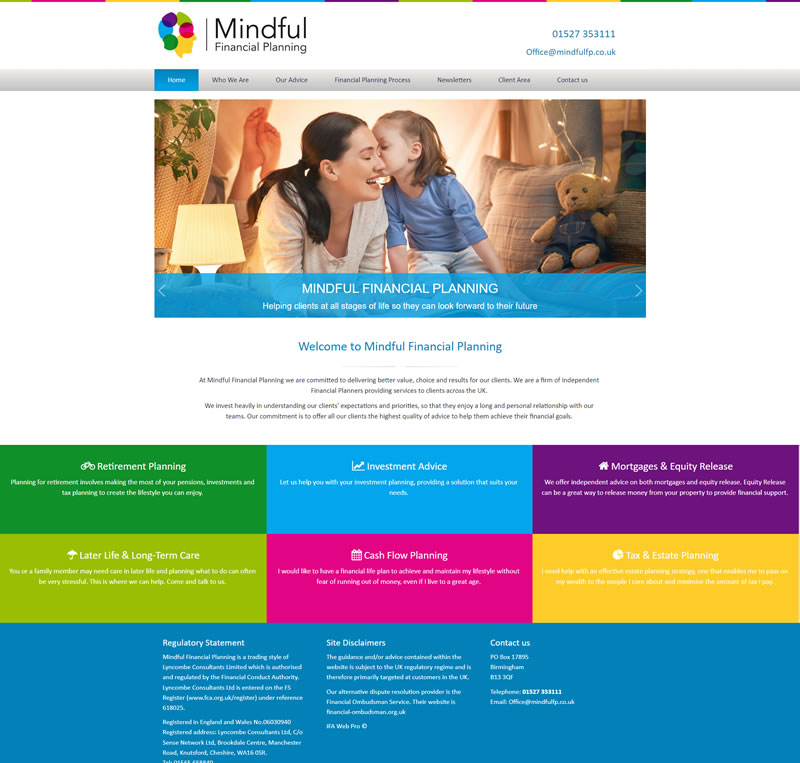

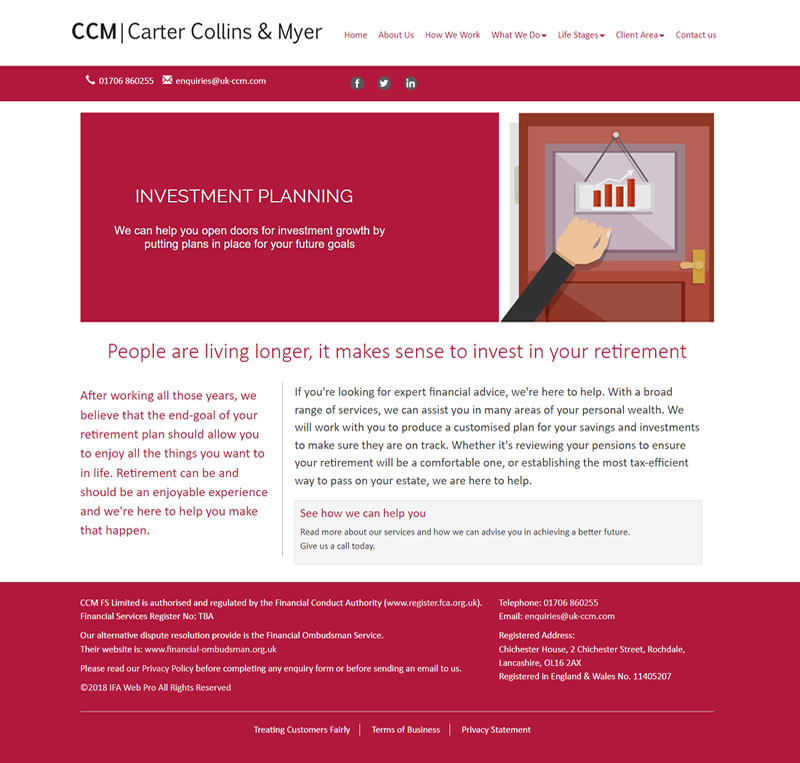

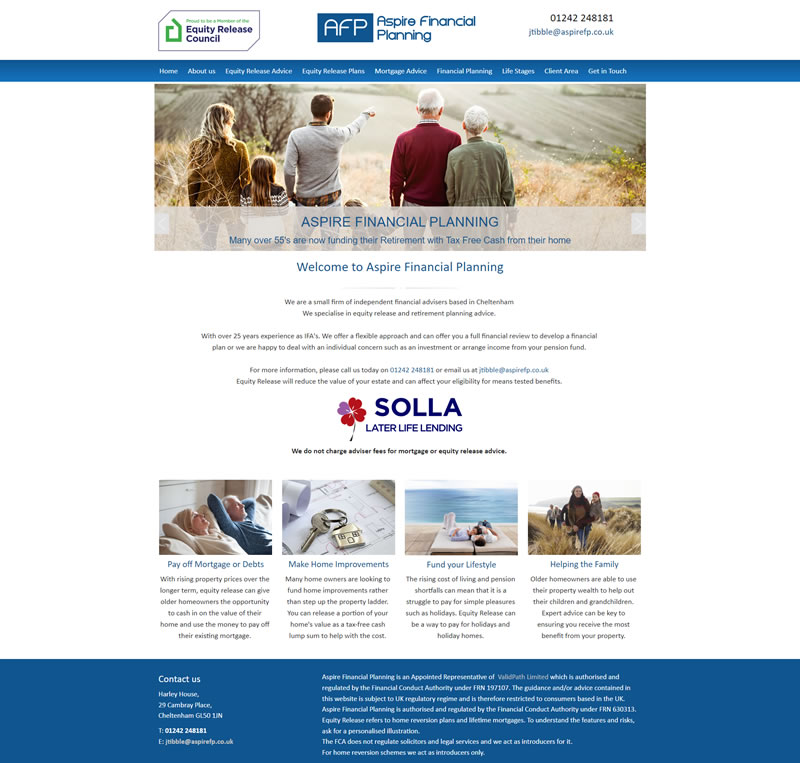

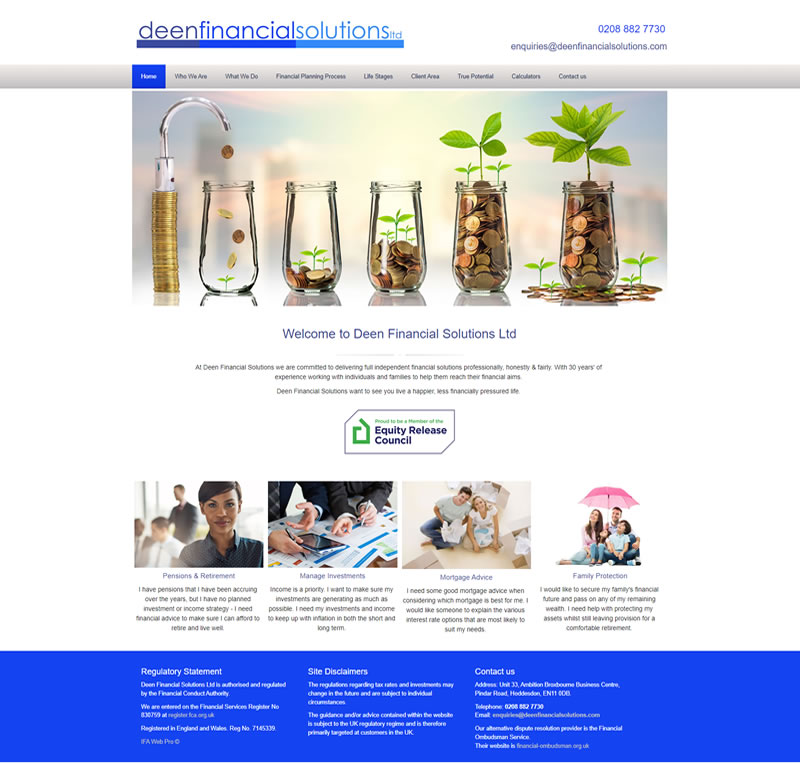

IFA Web Pro design, build and host semi-bespoke template websites for independent financial advisers (IFAs), financial planners, equity release and mortgage advisers.

We have a choice of stunning website templates, which we adapt to suit you. Creating beautiful, engaging, search engine optimised websites for the financial sector.

An all-in-one online marketing solution for IFAs is what we do best.

Not only do we develop a compliance approved website for IFAs, we provide quarterly branded marketing material too.

We have over 30 years of experience in Financial Services

Why not browse our services which include our financial website templates together with our regular online marketing for our financial advisers.

Client newsletters can be a great way to inspire trust and confidence by providing interesting and relevant articles.

They are also a simple and accessible way to engage your clients and to stay in touch.

If you're are a financial firm looking to provide ongoing value to your clients; then our free financial client newsletters can be a real bonus.

IFA Web Pro have a simple pricing structure for IFAs: £385 and then £40pm. Not only are we competitively priced, we promise we won't increase our fees.

Striving to meet every IFA client’s expectations by helping their IFA business to stand out.

Focusing on your IFA firm's needs, offering a personalised website build together with quarterly compliance approved client newsletters.

We deliver on every IFA client's needs: keeping your site up-to-date, taking care of IFA compliance submissions and any ongoing support.