Newsletters for IFAs and Financial Planning Firms

Newsletters are important in building and maintaining client relationships. They offer you the means of maintaining client contact

Our newsletters for independent financial advisers and financial planners are published quarterly in the Spring, Summer, Autumn and Winter. They contain the latest financial information relevant to your clients.

We can add your logo and colour to match or just use your firms name, we design each issue individually using professional images to bring each edition to life, we even add it to your website. You don't need to do anything.

Do you make the most of your newsletter?

Marketing your Financial business with your financial newsletter

have you thought about your IFA newsletter as a marketing tool? If not they maybe you should.

Your e-newsletter can work for you on a regular basis, helping you maintain client relationships. You can build up an email list on Mailchimp (don't worry it's free), save a standard template with your firm's logo and use your newsletter as part of your marketing (staying in touch) campaign).

It's always stay in touch with clients if you have a reason (or way in) to contact them.

Our Latest Client Publications

We produce quarterly newsletters for you to send to your clients; they are branded with your company regulatory details and approved by your network. They include topical information on Pensions and Retirement.

Mailchimp, it's free and easy to use

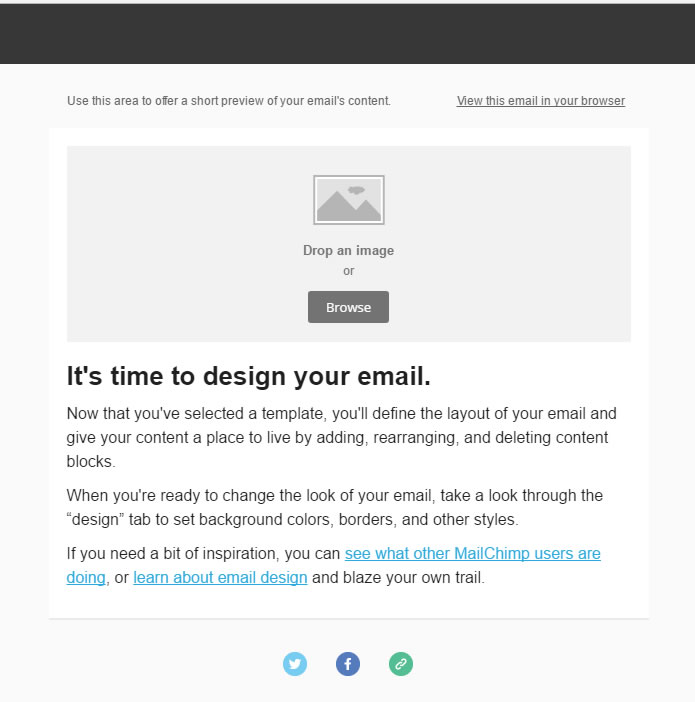

We have found Mailchimp to be a great marketing resource, it helps you get the most from your e-newsletters to life, with it's clever drag and drog image feature and email distribution list.

We used Mailchimp when we first started out, contacting IFAs and financial planners with website offers. It's a great tool, you can build up contact lists and see who has opened your email or clicked on any links. That did make the cold calling somewhat easier as we were able to identify prospects that may be interested in a financial website.

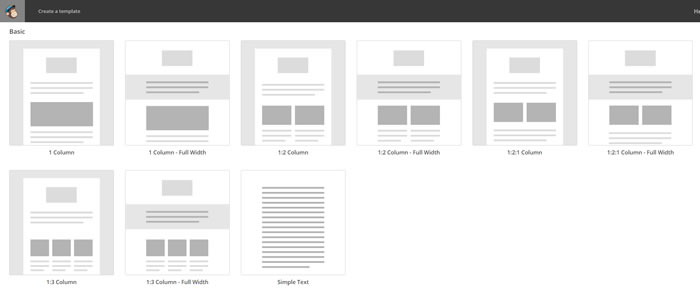

Mailchimp talks about campaigns and templates, don't be put off.

- List is a list of people you are wanting to send your e-newsletter to

- Template is the e-newsletter itself (design) that you are sending, you can create a new template or amend an existing one

- Campaign is the marketing campaign / email you are sending, email title and details, the use a template and list that you've just created

- Top tip You can use a stored template more than once and modify the content

Templates

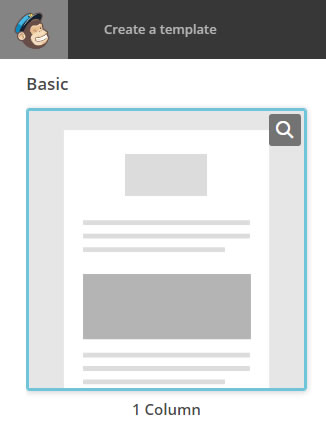

The newsletter templates are quite easy to use, primarily based on drag and drop technology. They're quite intuitive with plenty of help available.

| Choose a newsletter template | Get started creating your IFA newsletter! |

|

|

Use the free resource sections for your newsletter

Use the free resource sections on Mailchimp for “Tips for creating and gathering content”

Your content is the most important part of your newsletters. These tips will help as you start to create and gather compelling content that will speak to your readers.

People who subscribe to your email list are so into you that they've given you permission to their inboxes. Honor this privilege by letting them be the first to know about new products or sales. Give them access to special benefits as subscribers. Or go one step further, like clothing retailer Billy Reid, who sends exclusive sales to its readers with the highest member-activity ratings...

- Treat your readers like VIPs.

- Keep it useful.

- Show some personality.

- Keep it short.

- Get inspired.